Divorce can be expensive. Understanding both the short and long-term costs is essential for staying above water and landing on your feet when the ink dries on the divorce decree. At Simon Law Group, we help our clients take the steps necessary to minimize the financial costs of divorce as much as possible.

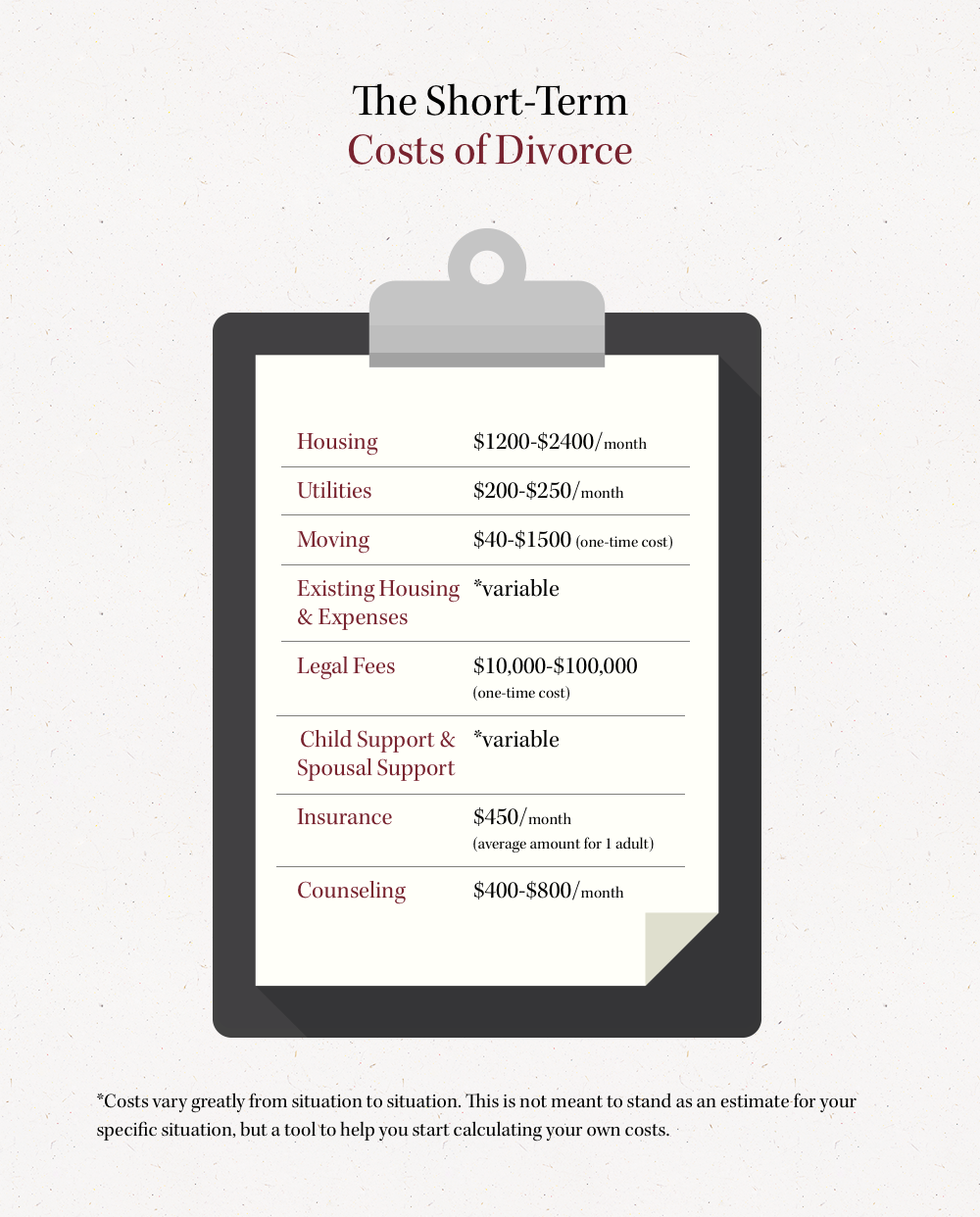

Short-Term Costs of Divorce

Your short-term costs will rise until your divorce is final. If your divorce is amicable, this could be as short as a year. If it’s contentious, it could be 18 months or even more. As much as possible, set money aside to cushion the blow. The following are some of the most common expenses you can expect when deciding that your marriage is no longer salvageable.

Housing – Median price for a studio apartment in Tempe runs around $1,200 a month, while a one-bedroom apartment is around $1,345. If you have children, you will want at least a two-bedroom apartment which will run around $1,689.

Utilities – You can expect to spend around $180 a month on gas, water, electricity, and trash. If you add internet to this, you can expect to spend slightly over $200 per month.

Moving – If you hire a mover, expect to pay anywhere from $1,000 to $1,500 for an in-town move. However, if you do it yourself, you can rent a U-Haul or Penske truck for around $40 a day.

Existing Housing & Expenses – If your name is on the existing mortgage, utility bills, credit cards, personal loans, etc., you will be responsible for those expenses. Therefore, it’s important to calculate these and set money aside to cover them in the short term.

Legal Fees – You will need to pay your attorney a retainer fee. The retainer covers the attorney’s time, filing fees, and other anticipated expenses associated with commencing divorce proceedings. The retainer is a deposit against future costs and time. If you expect a contentious divorce, you will want to discuss this with your attorney and estimate any additional funds you should earmark and set aside. In Arizona, even a simple and relatively uncontentious divorce case will cost $10,000-$20,000 on average. Contentious situations can easily cost $100,000 or more.

Child Support/Spousal Support – The court will issue temporary orders that may require you to pay child support or spousal support during the proceedings. This cost will depend on your income, your spouse’s income, the number of children, and other factors.

Children’s Education – Both parents are responsible for children’s education expenses in Arizona until the child is 18 and/or graduates from high school. If a child is in college, you should expect to continue the same contribution to their education during and after the proceedings. However, post high school education costs are purely voluntary and not mandated by statute.

Insurance – If you are on your spouse’s insurance plan, you can stay on that plan until you are divorced, after which COBRA allows you to stay on that plan for an additional 36 months. The same is true if your spouse is on your plan. The judge will determine who is responsible for insurance premiums and deductibles during proceedings.

Counseling – A divorce is an emotional event that shakes every aspect of your life. From your relationships with your children to the loss of companionship with your spouse, processing these emotions takes time. And counselors charge by the hour, roughly around $120 per hour in Arizona. Therefore, you should plan for at least one session per week throughout the divorce and until you feel you’ve processed the emotions and have developed strategies to mourn the loss of the union and cope with the “new normal.”

Take Care of Your Credit!

It can be tempting to let mortgage payments lapse, credit card balances grow, car payments slide, etc. Please don’t do it! Missing payments and letting bills lapse can cause serious damage to your credit. Having good credit when the dust settles is invaluable to helping you move forward in a positive direction.

The Past Is the Best Predictor of the Future

Look over your credit card statements, mortgage expenses, maintenance expenses, utilities, etc., for the past few years. This will guide what you can expect future expenses to look like and help you adjust your budget accordingly. In addition, looking at your past expenses can help you see areas where you can cut back, and conversely, where you will need to spend more in the future.

Let It Go

There are assets worth fighting for; there are assets that will cost you more than replacement. It’s one thing to fight for a fair distribution of retirement accounts, real property, heirlooms, and personal property. But, some assets aren’t worth what they will cost you to win in the divorce. When it comes to the division of property, pick your battles. Going into divorce with a “give and take” mindset can save you a fortune in legal fees.

Refinance Now!

If either spouse intends to keep the home, it is best to refinance the mortgage before the divorce is final. Whenever possible, before the papers are filed. Refinancing the mortgage before or early in the divorce process can help ensure the best rate and make it easier to qualify since you can claim both spouse’s incomes. This move can benefit both spouses and help ease the short and long-term financial costs of divorce in Arizona.

Save… Don’t Spend

Always plan to cut back on expenses. Cutting out vacations, coffee houses, restaurants, etc., can help cover some of the expenses associated with divorce. In the short term, always plan to cut back your expenses as much as possible to give yourself the largest financial cushion possible.

Long-Term, Post-Divorce Cost of Divorce

Meeting with your accountant and financial planner can help you see the bigger picture. These meetings are a wise expenditure of time and resources. Both can help you stabilize your ship so that you can stay on course and achieve the best long-term financial recovery possible.

Loss of Income – If you previously had a two-income household, you will need to recalibrate your budget minus your spouse’s income. This can have a significant impact on your lifestyle. It is crucial that you accept the change and don’t try to maintain the same lifestyle you had before the divorce if you can’t afford to do so. Living beyond your financial means may feel comfortable at first, but it can quickly dig a hole that you won’t easily dig out of as credit card bills, mortgage balances, car loans, etc., eat away at your savings.

Spousal Support – If you earned more than your spouse, the court might order you to pay spousal support for a specified period. In Arizona, this is typically between 30-50% of the duration of the marriage. So, if you were married for ten years, you can expect to pay spousal support for 3-5 years.

Child Support – If the court orders you to pay child support, this will continue until the child reaches the age of majority (18). However, if the child is still in high school when the child turns 18, you will need to pay until 19 or they graduate. However, if the child is mentally or physically disabled, the court can order payments to continue past this date.

Retirement – Your retirement savings will likely take a hit in the divorce. You may need to make distributions to your spouse. This means more than a change in the balance; it means less in terms of long-term growth and the account’s value when you retire. You may also need to reduce your monthly contributions based on your new budget. [Link to retirement article]

Insurance – Your insurance costs will likely go up since you will lose most volume discounts. This includes health insurance, life insurance, auto insurance, homeowners insurance policies, etc. However, careful planning makes it possible to bundle these under new policies and recoup much of the loss.

Taxes – These can go up or down depending on your income, liabilities, who gets to claim the children, etc. It is advisable to meet with your accountant during and after the divorce proceedings to determine the best tax strategies for your situation.

Education – The reality of the evolving economy means that continuing education is essential for job stability and long-term financial security. While some employers offer financial assistance for courses and advanced degrees, most do not. Thus, it is advisable to estimate how much you will need to invest so that you can enjoy the lifestyle you desire. Make this a priority in your budget! It will benefit your mental health by giving you something new to focus on as you move in a new direction, and it could mean a significant boost in long-term earning capacity.

Life Insurance, Wills, Social Security Benefits, etc. – You are likely no longer the beneficiary to your spouse’s life insurance policy, their will, their parent’s will, etc. While you may still be able to claim survivor benefits from a pension plan or Social Security, wait until the final divorce decree in Arizona to account for these changes. Don’t ever count these chickens before the judge brings them home to roost.

The team at Simon Law Group can help you prepare for the costs of divorce. We encourage you to contact our office at (480) 405-7568 to learn more about the strategies we use to help our clients achieve the best outcome in their divorce.