Is it Possible to “Split” Retirement Assets?

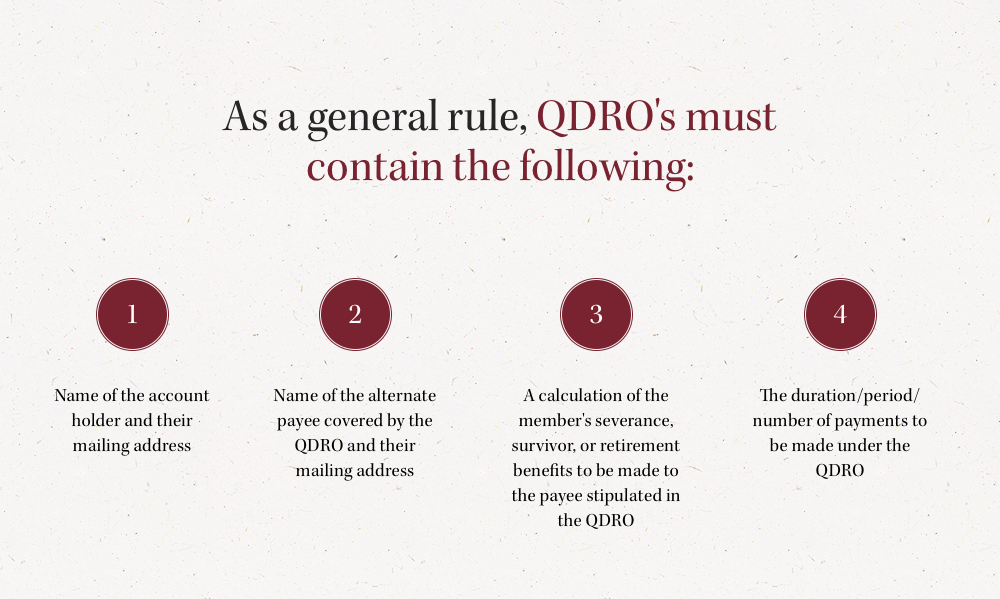

Retirement assets are considered marital property, and federal law allows for the division of these assets. Suppose you have a 401(k), 403(b), Thrift Savings Plan, or another qualified retirement asset; if so, the Employee Retirement Income Security Act establishes the requirements for a Qualified Domestic Relations Order or QDRO. The QDRO is essentially a blank form that your attorney receives from your plan administrator that your attorney completes and presents to the divorce court.

Once the judge signs the QDRO, the plan administrator is bound by law to distribute the assets as agreed. However, each plan requires specific language, and it is advisable to have your attorney speak with your plan administrator before submitting the QDRO to the court. This helps ensure that the language, etc. adheres to plan requirements and that there are no mistakes that could delay the distribution of the retirement asset.

Keep in mind that Roth and other IRA’s don’t require a QDRO to split. The tax code allows these to be split between both ex-spouses. This can be done without any tax penalty at any time within a year after the divorce is finalized.

How Should Retirement Assets Be Divided in Divorce?

Retirement assets represent a significant percentage of a couple’s net worth. In Arizona, retirement assets are considered community property. Unless otherwise stipulated within a prenuptial agreement, these assets will be equitably divided.

Since 401(k)’s and IRA’s have a daily cash balance, it is relatively easy to divide these defined contribution plans. All that needs to occur is to divide the balance based on the percentage specified within the QDRO. If you are the recipient spouse, it’s advisable to roll these funds into your personal 401(k); otherwise, you receive an unpleasant surprise from the IRS come tax day. Also, keep in mind that distributions made via a QDRO are exempt from IRS and early withdrawal penalties.

Defined benefit plans are a little trickier to divide. These are usually pension benefits, and many times pension plans are opened before the marriage. In most instances, any contributions and benefits accrued before the marriage and after the divorce are not considered marital property.

Arizona courts have considerable discretion on dividing defined benefit plans; this includes both vested and non-vested pensions. The first method is the “cash-out” method, which provides the receiving spouse with a one-time, lump-sum payment.

The courts can also opt for a deferred division approach. This entails assigning no current value to the pension plan but rather deciding to grant a defined share of both spouses’ benefits when the pension matures, and payments begin. This is similar to the reserved jurisdiction option, which stipulates that neither spouse receive any payment until the employee spouse reaches retirement age and is eligible to receive payments.

When dividing defined pension plans, it is always advisable to hire an actuary. These highly trained financial experts can accurately calculate the present value and future value of a defined benefit plan.

Minimizing Risk in a High Stakes Game

Divorce can create a significant financial burden for both spouses. If you are the recipient of retirement funds, it can feel like a windfall has landed in your lap. However, if you choose to spend the funds you receive, you will have to pay early dispersal penalties and taxes on this money. That can add up quickly. If you are young, the loss of long-term accrued interest and value in an IRA, 401(k), or pension plan can mean the difference between a comfortable retirement and one spent scrounging for pennies.

Of course, you could boost your contributions throughout the remainder of your career, but that’s a gamble. In fact, most financial advisors will discourage clients from spending any retirement funds they receive unless it is to pay off high-interest debts or invest in income-earning assets such as education to boost long-term earning potential. Again, this is something you should discuss with your financial advisor and a certified accountant.

If you are nearing the latter half of your career or getting close to qualifying for the Denny’s discount, you will want to preserve as much of your retirement assets as possible. It will mean some tough decisions, and it may require you to make trade off’s. For example, agreeing to accept a smaller share of the value of real estate assets in order to maintain the 401(k), IRA, or pension balance as much as possible.

However, there are many caveats and additional requirements. Thus, it is advisable to contact the SSA and determine how much of your Social Security benefits your ex may be entitled to receive. Or vice versa.

What About Military Pensions After Divorce?

Military pensions are based on years of service rather than regular monetary contributions. In order to receive a military pension, individuals must complete 20 years of active duty service. Payments are not made before the individual leaves the service, at which time payments are determined based on the number of years served, the pay rate at their time of retirement, plus any applicable cost of living adjustments.

Under the Uniformed Services Former Spouses Protection Act, up to 50% of the pension can be awarded to the non-serving spouse. Often, the amount awarded from military pensions is calculated as a percentage based on the number of marital years during which the serving spouse was in the military.

Keep in mind that regarding military pensions, the 10/10 requirement must be met for the Defense Finance & Accounting Service (DFAS) to send payments following receipt of a QDRO. That rule requires ten years of marriage, during which ten years were served in the military. If the 10/10 requirement is not met, the civilian ex-spouse must pursue other collection options.

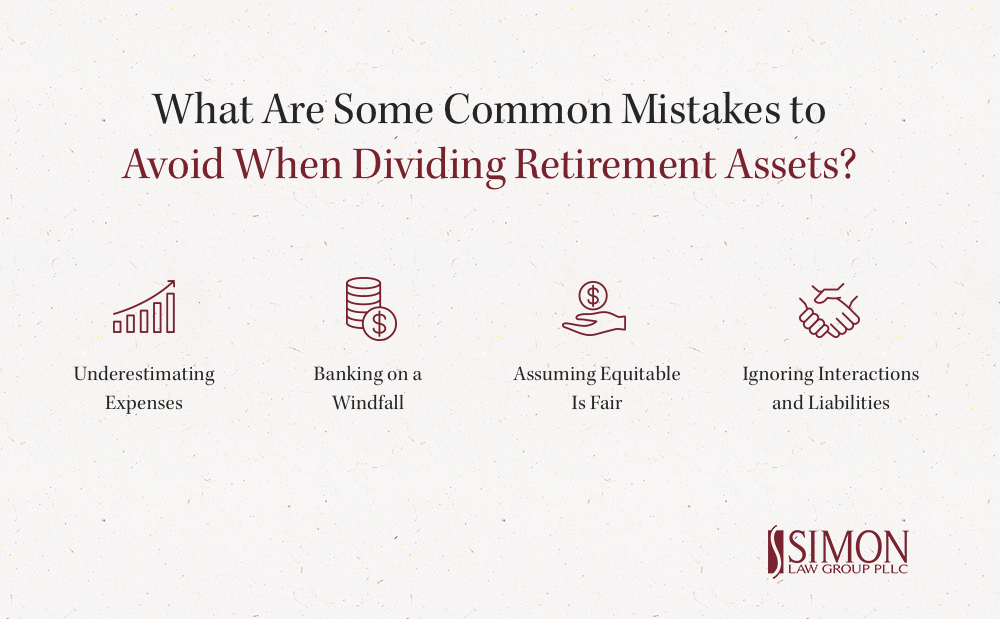

It is always better to learn from someone else’s mistakes rather than to make your own. When it comes to dividing retirement assets in a divorce, the following are some of the most common mistakes you will want to discuss with your attorney and financial advisor.

- Underestimating Expenses. Death, taxes, and inflation. All three are guaranteed. Always carefully account for taxes and inflation when estimating your future expenses. It is very easy to underestimate these, more so the further away retirement is in the future.

- Banking on a Windfall. Maybe your book will become a bestseller. Maybe your rich uncle will leave you a fortune. Maybe your portfolio will generate 20% returns year after year. Or, most likely not. It would be best if you never banked on long shots to fill gaps in your finances or retirement portfolio.

- Assuming Equal is Fair. The law doesn’t require an equal distribution of assets; it requires an equitable distribution. Thus, the courts will consider both spouse’s age, earning potential, contributions to the marriage, etc., when dividing assets. Your goal going into divorce proceedings should be to secure those assets which generate the largest long-term benefit for your needs.

- Ignoring Interactions and Liabilities. Divorce is a chain reaction, and your calculations should always take into account taxes, interest, timing, inflation, capital gains, future income, spousal support, child support, etc.

The team at Simon Law Group, PLLC, can help you navigate the division of retirement assets during your divorce. We encourage you to contact us at (480) 771-7634 for a free consultation and to learn more about the strategies we use to protect our client’s nest egg.

To view the entire infographic, click the image below.