Focus on Preserving the Value of the Business

Divorce is never easy. Even an amicable divorce can significantly impact your schedule, your mental health, and your ability to serve your clients. Thus, when divorce is in the cards, it is essential for you to prioritize the preservation of your business. Focusing on your day-to-day duties, company goals, and the tasks that make your business a valuable asset is imperative. Doing so helps preserve staff morale and operational continuity. If you don’t focus on running the business, your business can suffer significant harm, and you can lose everything from clients to brand reputation before the dust of the divorce settles.

In most instances, it is advisable to designate a trusted and reliable staff member to take over some of your Arizona small business’ managerial duties during your divorce. This helps ensure operational stability and allows you to attend meetings with your attorney, court appointments, counseling appointments, etc., without disrupting the business. The more you can minimize disruptions to the company, the better.

Determine the Status of the Business

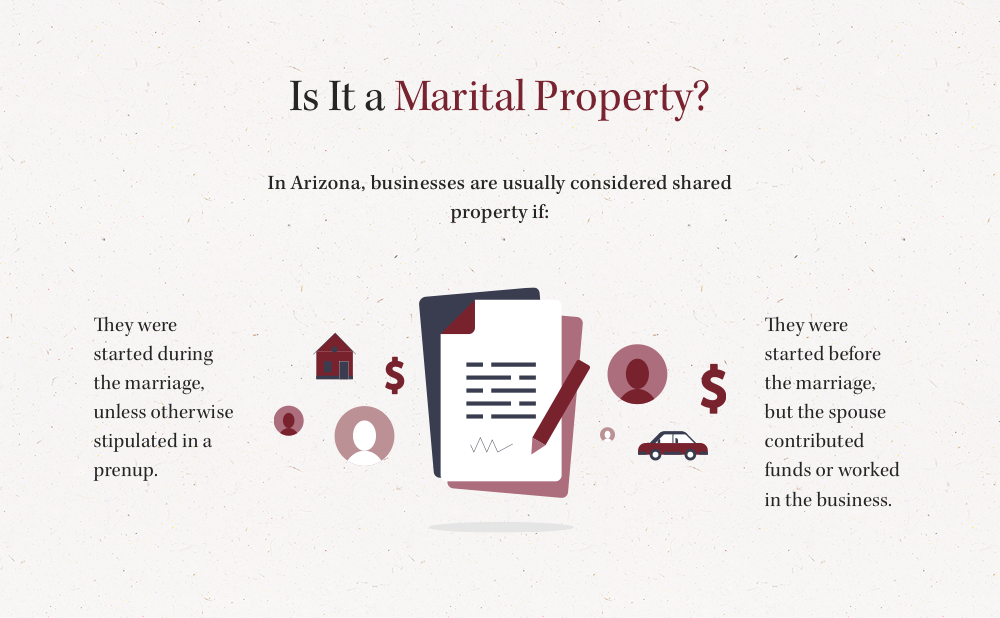

The first thing to determine is whether the business is a marital asset or if it predates the marriage and is thus separate property. It is important to remember that Arizona law considers that companies that predate the marriage can become marital property if the other spouse contributes to the business during the marriage. For example, if the spouse worked in the business or contributed their funds to support the business. Unless otherwise stipulated within a Prenuptial or Post Nuptial Agreement, most businesses started during the marriage are considered marital property.

If the business is separate property, the other spouse has no interest or claim to the business, including any business assets or revenue. This makes the division clean and simple. Conversely, if it is determined that the business is marital property, both spouses will need to determine the value of the business, and identify an equitable manner to divide the asset as part of the marital estate.

Determining Value

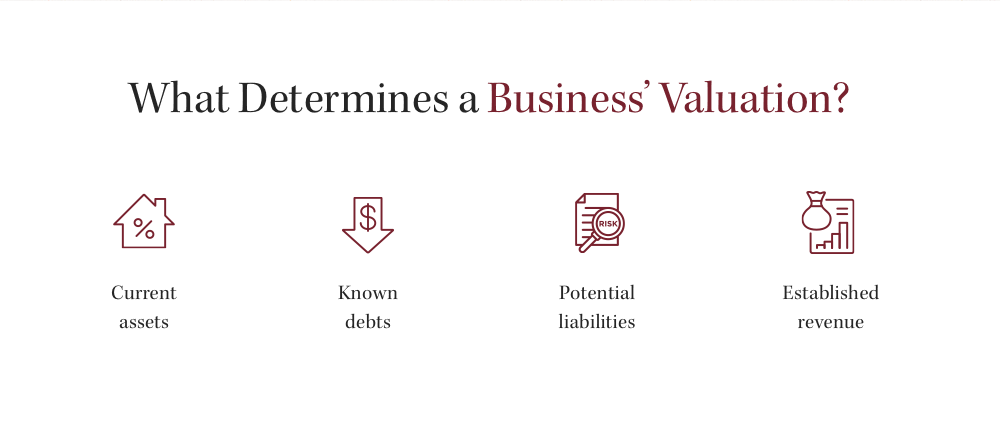

Your divorce attorney in Arizona will recommend that both spouses seek an independent valuation of the small business. This examination should be performed by a professional who has earned an accreditation in business valuation. For instance, an Accredited Senior Appraiser (ASA) or Certified Public Accountant (CPA). These third-party appraisers have completed specialized training that allows them to arrive at an accurate valuation. The detailed report your business valuation appraiser provides will estimate the fair market value of the business based upon the business’ current assets, established revenue, known debts, and other liabilities.

As can be expected, two different examinations can result in two different appraisals of your small business. Usually, the appraisals are fairly close to one another. However, in instances where the third-party appraisals offer significantly different valuations, Arizona courts have the discretion to determine which expert’s opinion to accept.

As such, even when you don’t anticipate a contentious dissolution of your marital assets, including your small business, you should choose your appraiser carefully and select an individual with impeccable expertise and experience. This is because even the most amicable divorce can become contentious when money is on the table. Hiring the best expert you can afford will help you protect your interest in the business and ensure a fair and equitable distribution of the marital estate.

Dividing A Professional Business

Once you know the disposition and value of the small business, it is necessary to determine the best way to divide it. But, there is still more to do before this can begin. If it is a legal practice, medical practice, dental practice, or other enterprise requiring licensure, only the licensed spouse can own and operate the business. In these situations, the licensed spouse can buy out the other spouse’s interest.

If both spouses are attorneys, doctors, psychologists, or another licensed professional service provider, work in the business, and express a desire to continue the business, it is possible to divide the clients, physical assets, business name, etc.

Dividing Other Small Businesses in Arizona

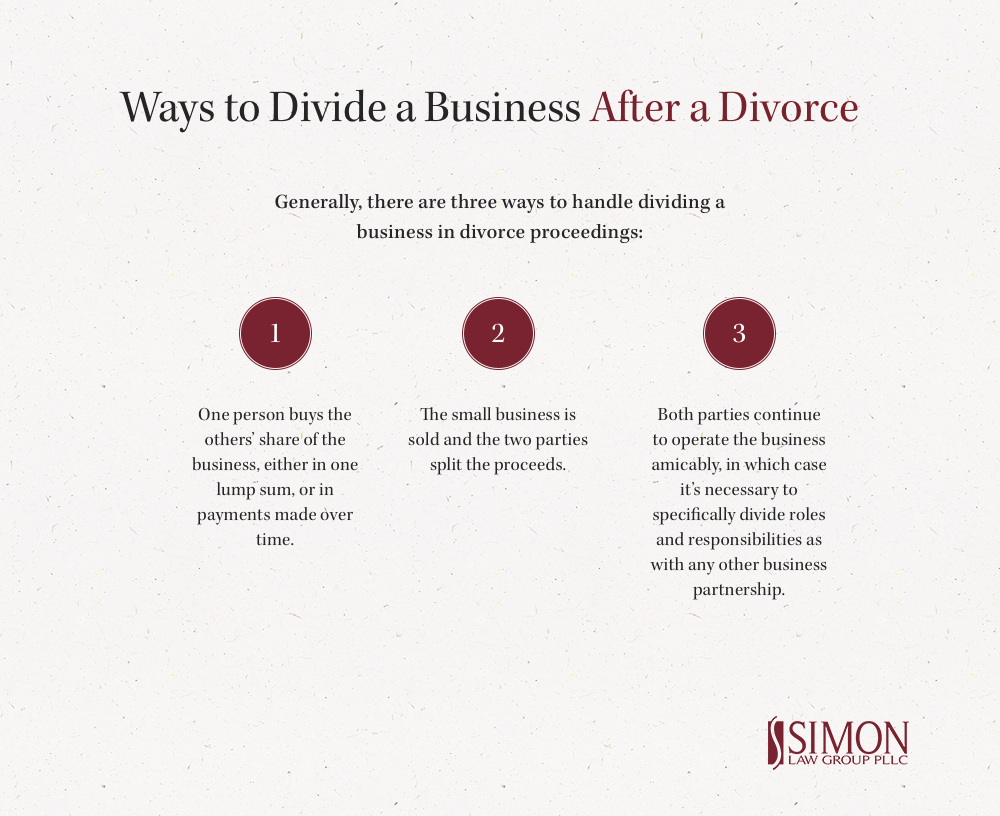

For other small businesses, such as restaurants, auto repair shops, gas stations, etc., the process is usually much simpler. In most cases, one spouse will buy out the other spouse’s interest in the Arizona business. Using the accepted fair market valuation as a guide, the spouse can purchase the other spouse’s half of the business.

Ideally, this will involve a lump sum payment to the other spouse. If the business has sufficient liquidity and assets, the receiving spouse can apply for mezzanine financing from their lender to secure the cash needed to make that payment. This is the most common strategy business owners use when dividing businesses in an Arizona divorce.

In many cases, spouses will agree to a structured settlement. This allows the purchasing spouse to make payments for the purchase of the small business over a set period of time. This can be advantageous to both spouses as it provides a steady income to the receiving spouse and alleviates the immediate financial burden on the purchasing spouse. However, it is also a risky option for the receiving spouse. If the small business falters or fails, the payments can stop, and they can find themselves far down the list of creditors during bankruptcy proceedings.

Another possible option is to offer the other spouse a greater share of retirement accounts, the marital home, or other assets. This can be beneficial to both spouses because it preserves the value of a 401(K), IRA, etc. as it avoids early withdrawal penalties, taxes on real property sales, broker fees, etc.

Selling the Small Business

There are some instances when a small business simply can’t be divided and it is best to liquidate the asset altogether. For example, if there are insufficient assets, the purchasing spouse can’t secure mezzanine financing, or there are unresolvable disputes over the valuation of the business.

When this happens, it is usually best to sell the business and divide the proceeds. Unless an Arizona court orders the couple to sell the business, this must be a mutually agreed-upon decision. Upon the business’s sale, both spouses receive the agreed-upon share of the proceeds after all fees, expenses, taxes, etc., are settled.

The sale of a small business is rarely an easy decision to reach. Many small business owners invest years, if not decades, building the business and establishing relationships in their community. Moreover, this decision must take into account the business’ branding, economic conditions, staff considerations, pending work, and other factors. If the couple decides to sell the small business at the wrong time, both spouses can end up losing.

Dividing a Small Business in an Amicable Divorce

Many spouses can remain friends, and some even remain business partners following a divorce. When the divorce is amicable, both spouses can maintain their interest in the business and continue operating the enterprise. When both spouses agree to continue the business, it is necessary to determine each spouse’s role post-divorce. Will the business be co-managed, or will one spouse have primary management authority? How will profits be divided? Will there be a buyout clause if one spouse changes their mind down the road?

Addressing Relevant Taxes

In most cases, the buyout of a business during a divorce is not taxable. The buyout is considered a tax-free non-recognition event under both state and federal tax codes. However, to qualify, the transfer must commence within one year of the marriage’s dissolution and conclude no later than six years after the date of dissolution. Finally, the transfer must be court-ordered by the separation instrument.

Because there are many nuances to the tax code, it is imperative to discuss and address potential tax liabilities with a CPA before agreeing to any division of business interests.

We encourage you to contact Simon Law Group, PLLC at (480) 900-1358 to schedule a consultation with our team. Our legal professionals understand the challenges inherent to dividing a business in an Arizona divorce. It is our pleasure to help prepare you for the process and guide you towards your desired outcome.

To view the entire infographic, click the image below.